2. Tax implications of taking up residency and Inheritance tax

Difference between EU and non-EU citizenship for the residence permit

There are no restrictions for the purchase of residential real estate in Switzerland by EU citizens (permits B or C). Non-EU citizens need to wait for a permanent residence status (permit C) to purchase residential real estate other than their principal residence..

Purchase and sale of property as a resident

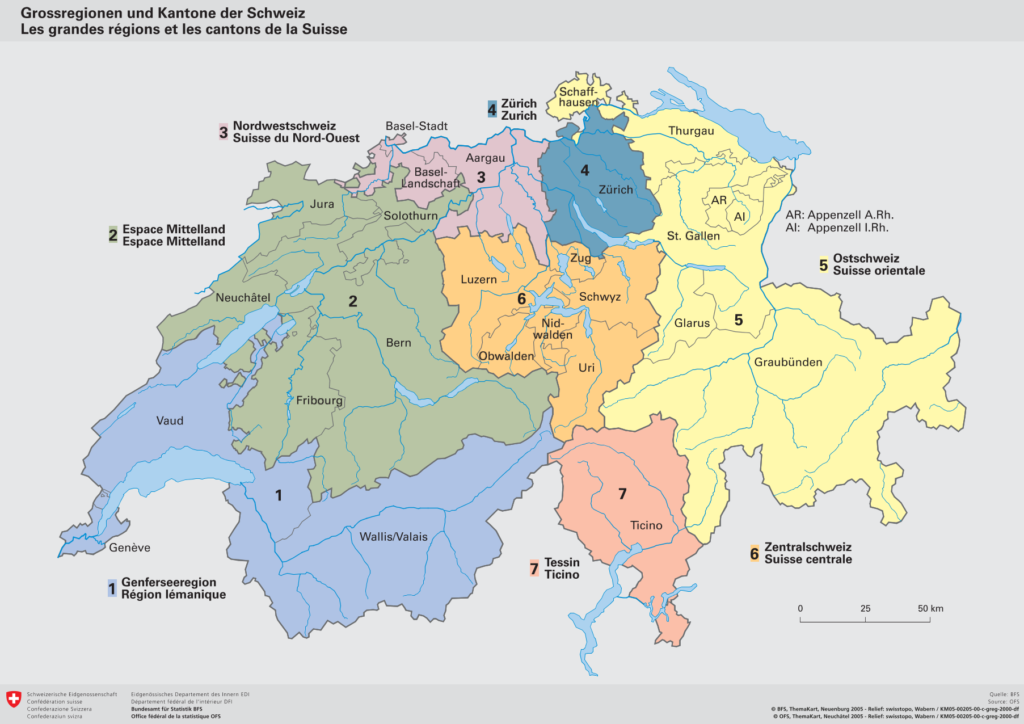

With the exception of Zurich and Schwytz, all cantons deduct transfer rights from the purchase price or from the fiscal value of the property. In most cantons, the buyer is subjected to transfer rights, whereas in some cantons half of this tax is paid by one or both parties, according to the purchase contract terms. The rate of the transfer rights is calculated differently in each canton and generally varies between 0,5 % and 3 % of the purchase price. Most cantons also favour land register rights at a few-tenths of 1 %, which can go up to 1 % in certain exceptional circumstances. In some cantons, the solicitor invoices his services by the hour, whereas in others the fees are calculated as a percentage equivalent to a few-tenths of 1 % of the purchase price. Traditionally, all real estate agency fees are paid by the seller, unless there is a previously existing agreement or if the buyer signs a study mandate for a customised study.

With the exception of Zürich and Schwyz, all cantons levy a transfer tax on the purchase price or the tax value of the property. In most cantons the purchaser is liable for the transfer tax, whereas in some cantons 50% tax is paid by both parties or by one party according to the purchase contract. The transfer tax rate is calculated differently in each canton and varies in general between approximately 0.5% and 3%.

In addition, most cantons levy a land register fee of a few tenths of a per cent, reaching 1% in exceptional cases. In some cantons, the notary charges for his services according to the time spent, and in others, fees are based on a percentage of a few tenths of a per cent of the purchase price. Traditionally, all real estate agency fees are paid by the seller unless agreed in advance or if a buyer signs a search mandate to provide a bespoke search service.

Tax implications of taking up residency

In general, according to Swiss law, a B permit holder has the status of a fiscal resident in Switzerland. According to Swiss tax law, worldwide income and worldwide wealth are taxable in Switzerland and have to be declared. As taxes are levied on a federal, cantonal and communal level, the tax rates vary in each commune and are progressive.

The lowest maximum income tax rates are at approximately 20%, the highest at around 42%. In addition to the worldwide income, a deemed rental value of the Swiss real estate will be taxed as income in Switzerland. On the other hand, maintenance costs and mortgage interests are fully deductible from the taxable income. Worldwide movable assets and real estate in Switzerland are subject to cantonal and communal wealth taxes. Wealth tax is levied on net assets, consequently mortgages and other loans are deducted from the tax value of assets. Net assets are taxed at progressive rates which reach a maximum between approximately 0.1%-1% depending on the cantonal and communal tax rates.

Flat rate

For non-Swiss citizens without any gainful activity in Switzerland, a large number of cantons provide for a taxation according to the rental value (typically multiplying the annual rental value by 7) of the Swiss property as well as the living costs and does not consider a client’s worldwide income. Furthermore, tax authorities require a minimum tax burden of at least CHF 400,000 to grant lump sum taxation in the case of real estate with a relatively low tax value. For reference, this lump sum taxation is also called (Pauschalbesteuerung, forfait fiscal, tassazione globale).